Digital banks and card issuers are pressured to compete like sprinters. It took Timo in Vietnam only 4 months to launch an award-winning digital bank with a unique human touch concept that targets 5 million cardholders. Enfuce, a recognized CaaS leader in Europe, onboards B2B clients in 8 weeks instead of the industry average of six months. LOTTE, the Korean brand, entered another country’s market as a BNPL disruptor with near-instant loan approval for e-commerce. What do these winners have in common?

Just like Olympic athletes, payments players perform the best when running in their own shoes – operating a highly flexible platform that adapts quickly to new business models and customer segments. On top of that, they need to rely on a partner with a multi-expert team. There are strategic choices to make collaboratively at every stage – from blueprint through delivery to post-launch revenue diversification.

OpenWay has analyzed the best practices of Timo, Enfuce, LOTTE, French card providers Memo Bank and Welcome Place, provider of QR-based credit products Mirae Asset, and other brands whose cards are issued on OpenWay’s Way4 platform. Read the case study to get insights on:

- Why 24/7 real-time accounting and reconciliation boosts adoption of digital cards and payments

- Who has reported cost savings after migrating to a unified back- and front-end

- Ways to speed up expansion to new geographic markets

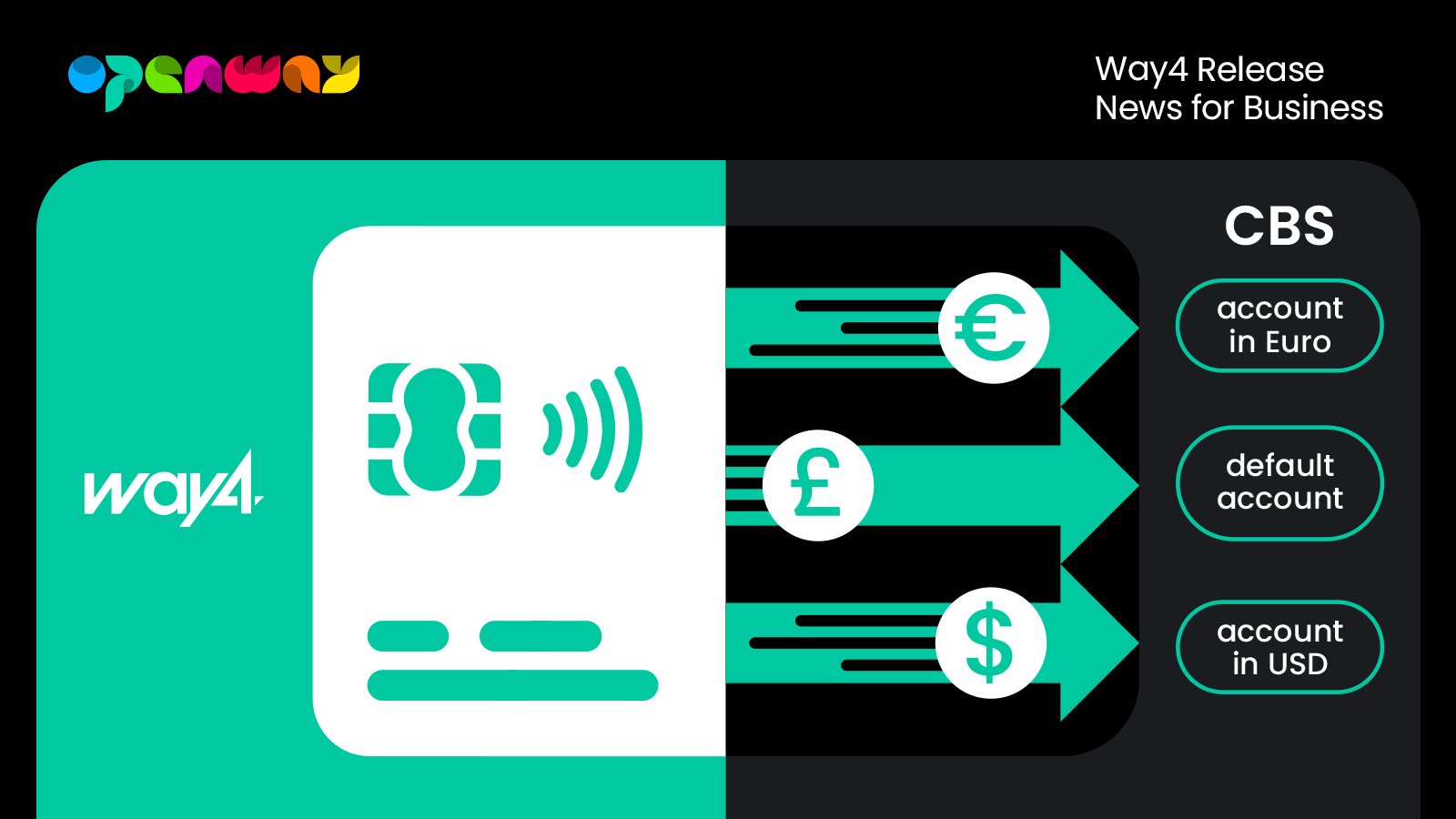

- How to measure flexibility: a single platform that supports at least 3 different onboarding workflows for the same customer segment; repurposes your prepaid cards for 3 different regions without hard coding; bundles any card type with multi-currency accounting and value-added ESG services; and more

Rudy Gunawan, Managing Director of OpenWay Asia, shares insight on award-winning cards and digital lending products. He reveals multiple benefits of real-time straight-through processing, and why this has become a must-have to ensure rapid adoption of retail banking offerings. He also outlines the project management strategies that help OpenWay clients launch innovations and access new markets at near-Olympic speed.

OpenWay is the developer and provider of the Way4 digital payments software platform for tier-1, mid-size and startup players – including card issuers, acquirers, processors, telcos, payment switches, fleet companies, and digital wallet providers. Gartner, Omdia, and Aite have ranked OpenWay as the best digital payments software provider and the best payment solution in the cloud.